*Please see the following information for online, phone, or mailing instructions from each of the three major credit reporting agencies to unfreeze your credit file: 1265 (PDF) which starting Jwill require credit reporting agencies to not charge a credit report fee to temporarily freeze your credit within a twelve month period but then they may assess a fee if you unfreeze your credit. Idaho Residents: The Idaho legislature passed bill S.

#Temporarily unfreeze equifax plus#

Credit Plus is not responsible for any damages or losses arising from any use of this information. This information is provided for general informational purposes only and is not intended to convey or constitute legal advice and should not be relied upon in lieu of consultation with appropriate legal advisors.

© 2017 Credit Plus, Inc, Permission granted to use this information.

Please refer to each credit bureau’s state-specific requirements below.

#Temporarily unfreeze equifax code#

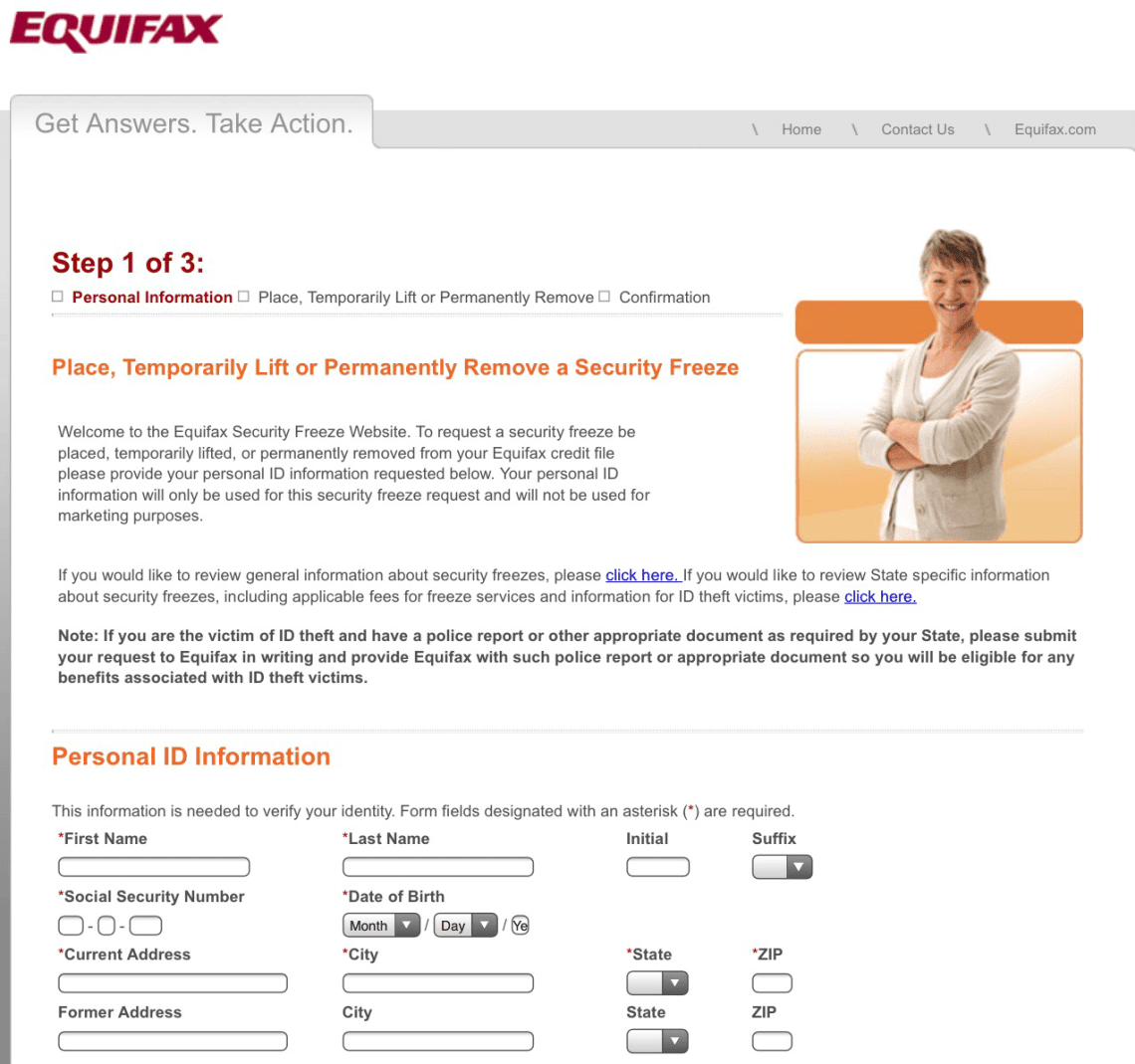

TransUnion® issues an eight-character access code beginning with the letters “TU”.However, if temporarily, you may need to provide further authorization in order for your loan officer to pull your credit file.Įach credit bureau has different requirements: You can unfreeze your file permanently or temporarily. To do this, you must contact each credit bureau directly, typically by mail, telephone, or online to obtain a file, access you PIN, and/or request that the file be unfrozen. If you are applying for a mortgage or other loans and have frozen credit files, you must unfreeze them with the credit bureaus in order for a lender to pull your credit report. Financial Peace University – Dave Ramsey.

0 kommentar(er)

0 kommentar(er)